While the DOL (“fiduciary”) and the SEC (“best interest”) debate their applicable standards, I suggest that cost-efficiency should be a key factor in whatever they decide. Even former SEC chairman Jay Clayton discussed the importance of cost-efficiency re “best interest.”

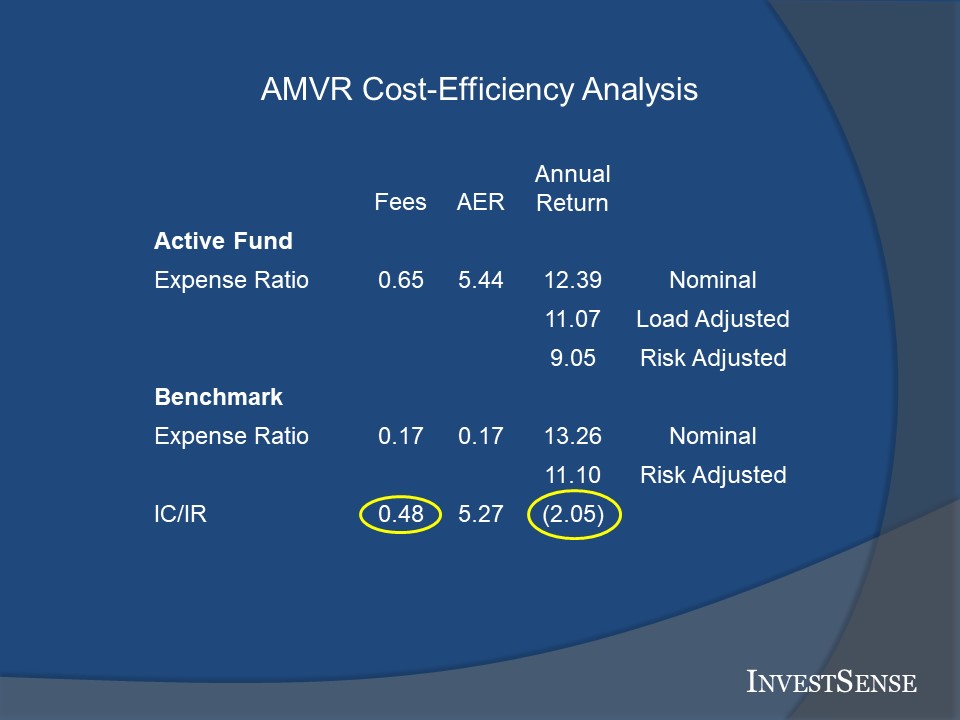

In my practice, when I meet with a HNW investor or an investment fiduciary such as a plan sponsor, I show them an AMVR analysis of two well- known actively managed mutual funds. They regularly appear in personal accounts and 401(k)/403(b) plans. I then ask them if they would consider the fund to be prudent and/or in their “best interest.”

Then I explain how to use the AMVR using two simple questions:

(1) Does the actively managed fund provide a positive incremental return?

(2)If so, does that positive return exceed the fund’s incremental costs?

If the answer to either question is “no,” then the active fund is not cost-efficient relative to the passive benchmark fund. Can anyone honestly argue that a cost-inefficient mutual fund is either prudent or in an investor’s “best interest?”

Simple and straightforward, John Bogle’s “Humble Arithmetic .”

“Simple is the new sophistication.” – Steve Jobs