By James W. Watkins, III, J.D., CFP Board Emeritus™, AWMA®

Quick Answer – Because mutual fund companies, insurance companies, and broker-dealers that peddle the actively managed mutual funds and annuities they offer cannot meet such a standard. Ask yourself, why is it that every time “fiduciary standard” is mentioned, the aforementioned “Unholy Trinity” immediately run to the courts and Congress begging for protection and promoting ruses such as “preservation of choice” to justify any legitimate attempt at much needed investor protection.

Fortunately, this battle of the best interests, the battle over protecting investors or promoting the best interests of the Unholy Trinity, seems to be coming to a close in connection with 401(k) plans and other types of pension plans. The Supreme Court and several other federal courts have increasingly recognized the inequitable practices some pension plans have been engaging in and ordered the plans to comply with ERISA, the federal law that protects various groups of employees.

Unfortunately, retail investors are still being subjected to misleading marketing and other questionable trade practices. The Securities and Exchange Commission (SEC) recently enacted “Regulation Best Interest” (Reg BI) instead of simply adopting a true fiduciary standard similar to the standard that registered investment advisers (RIAs) must follow.

Some have suggested that the Reg BI is anything but in the public’s best interest, citing “loopholes” such as the “readily available alternatives” clause that seemingly allows broker-dealers and other “financial advisers” to limit investment recommendations to the overpriced and consistently underperforming, i.e., cost-inefficient, products offered by their “preferred providers.”

As I quickly learned as a compliance director, preferred providers pay broker-dealers a tidy sum in order to have access to the broker-dealer’s brokers, who are then restricted to recommending only the products of their preferred providers. Customers are often unaware of this obvious conflict of interest and its potential impact on the quality of advice that they receive.

Back in 2007, the Financial Planning Association sued the SEC1, alleging that the SEC was allowing Merrill Lynch to offer advisory services without requiring that the brokerage firm register as an investment adviser and comply with the fiduciary standard required federal law. In the course of the litigation, the SEC proposed to settle the case by requiring the following disclosure to all brokerage customers:

The Court and the FPA rejected the disclosure. The SEC lost the case and the suggested disclosure language proposal was dropped, despite the obvious benefit that it would have provided to investors by disclosing the inherent conflict of interest between investors and brokers and the resulting quality of advice issues investors need to consider.

Lies, Damned Lies, and Financial Services Marketing

Back in my compliance days, it seemed like I was always engaged in a battle with the marketing department. My job was to protect the firm and its brokers by requiring compliance with all applicable securities laws. So, naturally, I refused to approve the use of any in-house or third-party marketing material unless and until they could provide me with an unconditional approval letter from the regulators.

I was constantly having to deal with mutual fund and annuity companies going behind my back and trying to convince the brokers to use marketing pieces that the companies could not get approved. The sales director, the marketing department, and the product wholesalers would rage and call me very mean and nasty names. My response would always be the same – “Do you have the unconditional approval letter?”

When securities regulators reject a marketing piece, they always provide the reason for the rejection. So, everyone knew what needed to be done to obtain an unconditional approval letter. The problem was that if the necessary changes were made, no customer in their right mind would be interested in the product. Some twenty-five years later, nothing has changed.

The Devil Is in the Details – How to Read and Interpret Investment Ads

Those who follow me on LinkedIn and my sister blog, “The Prudent Investment Fiduciary Rules,” know that I am an advocate of analyzing investments in terms of cost-efficiency, not just the performance of an investment. I created a simple metric, the Active Management Value RatioTM (AMVR), that allows investors, investment fiduciaries, and attorneys to quickly evaluate the cost-efficiency of an actively managed mutual fund. What the AMVR and studies consistently show is that the overwhelmingly majority of actively managed mutual funds are not cost-efficient and, therefore, not in the best interests of investors.

In analyzing an AMVR analysis, the user only needs to answer two simple questions:

(1) Did the actively managed fund provide a positive incremental return?

(2) If so, did actively managed fund’s positive incremental return exceed the fund’s incremental costs.

If the answer to either of these questions is “no,” then, under the Restatement’s standards, the actively managed fund is imprudent relative to the benchmark index fund.

In this case, the answer to both questions is “no.” Therefore, the fund is not a prudent investment choice. Both the Department of Labor and the General Accountability Office2 are on record as saying that each additional one percent in fees/costs reduces an investor’s end-return by approximately 17 percent over a 20-year period. Using those guidelines and viewing the fund’s underperformance as an opportunity cost, an investment in the fund shown would project to a loss of 43.69 percent. And yet, Congress and the financial services ignore such overwhelming evidence and try to defend such investor abuse as the need for “choice.” A cost-inefficient investment never has, and never will, constitute a legitimate legal “choice.”

Investors face the same sort of misleading marketing tactics with regard to annuities. Annuities were always the biggest problem I faced during my compliance days, I had the pleasure of working with some incredibly talented and dedicated brokers and investment advisers during my compliance days.

Then there were the annuity folks, both brokers and wholesalers. Mondays are usually when broker-dealers hold their weekly sales meetings. I remember the day the annuity wholesaler came in to pitch the new equity indexed annuity (EIA), more commonly known as indexed annuities and fixed indexed annuities (FIAs).

Knowing my position on annuities in general, the brokers kept turning around and looking at me. I was sitting in the back of the room, next to the brokerage director, who leaned over and asked me if we were going to be selling EIAs. I told him I was not going to sign off on any and he agreed. I still maintain that they are overly complicated and deliberately mislead investors. For more information on annuities, read my article on the fiduciary liability issues inherent in annuities

Supreme Court Justice Louis Brandeis once said that “sunshine is the best disinfectant.” On the other hand, transparency is the financial service industry’s kryptonite. Annuities are Exhibit A for that argument, as they seem to be included in the SEC’s annual list of leading consumer complaints.

“Framing” refers to the method used to present an idea or product in hopes of receiving the desired response. A familiar saying in the investment industry is that “annuities are sold, not bought.” To sell a “problem” product, brokers are often told to “put lipstick on a pig” and/or “Sell the sizzle, not the steak.”

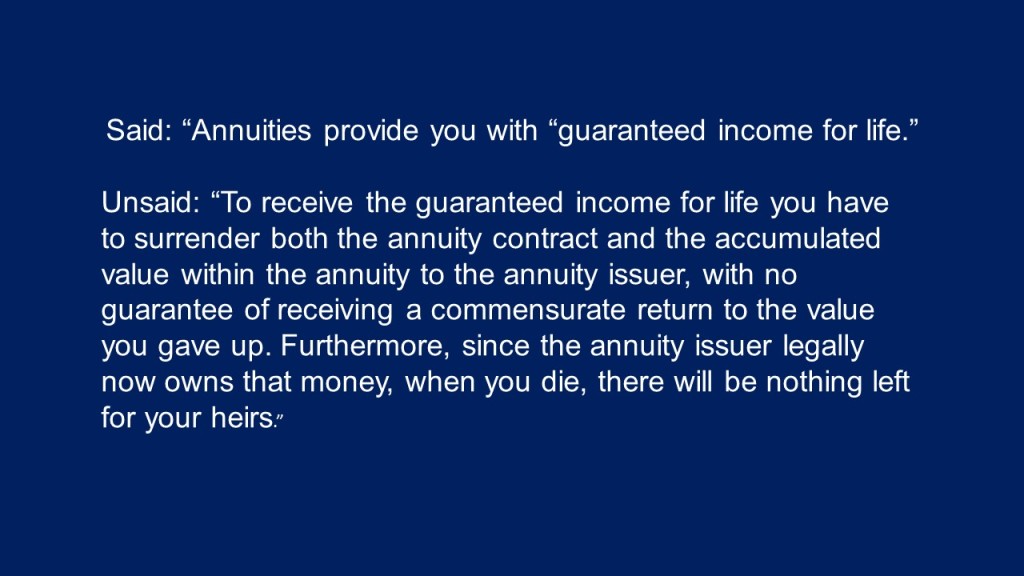

Annuity salespeople typically frame their sales presentation using the spiel that annuities offer “guaranteed income for life” and “who does not want guaranteed income for life.” But as the late Peter Katt used to always warn, the key question is “at what cost?”

When I speak to groups on the subject of annuities, I always use the following slide to frame my own presentation:

“At what cost” indeed. Still interested in annuities and “guaranteed income for life. Guaranteed income in retirement is all good and well, However, there other viable options such as dividends and bonds that provide the income without requiring an investor to make such sacrifices and destroy their estate plans for their family and other heirs.

Investors say that the annuity salespeople do not disclose that aspect of many annuities to them, just “guaranteed income for life.” In fairness, insurance salespeople are typically not held to a fiduciary standard, only, at best, a “best interest” standard. Even then, the level of enforcement of regulations by some state insurance commissioners leave much to desire.

Going Forward

When it comes to investor protection, I am admittedly biased by my experiences as both a securities compliance director, a plaintiff’s attorney, and an ERISA attorney/risk management counsel. In my public presentations to investors and plan sponsors, I offer the following quote from the Court in Archer v. SEC:

The business of trading in securities is one in which opportunities for dishonesty are of constant recurrence and ever present. It engages acute, active minds, trained to quick apprehension, decision and action. The Congress has seen fit to regulate this business. Though such regulation must be done in strict subordination to constitutional and lawful safeguards of individual rights, it is to be enforced notwithstanding the frauds to be suppressed may take on more subtle and involved forms than those in which dishonesty manifests itself in cruder and less specialized activities.3

Unfortunately, today’s investors must assume a greater role in protecting their best interests. A good starting point is to always ask a broker or insurance salesperson whether they will be acting in a fiduciary capacity and in accordance with a fiduciary standard in providing recommendations and other investment advice. If they say “yes,” then ask them if they are willing to put that promise in writing, signed by both them and their supervising broker-dealer/insurance company.

Brokers and insurance agents will typically refuse to provide such guarantees in writing, responding that they are not legally required to provide such promises. That may or not be true, as some states do hold brokers and insurance professionals to a fiduciary standard, or at least a best interest standard.”

Hopefully, this post has convinced the reader of both their right and prudence in insisting on the higher level of care and liability of a fiduciary standard from those advising them and/or managing their financial affairs.

Notes

1. Financial Planning Association v. Securities and Exchange Commission, 482 F.3d 481 (D.C.C. 2007)

2. Pension and Welfare Benefits Administration, “Study of 401(k) Plan Fees and Expenses,” (“DOL Study) http://www.DepartmentofLabor.gov/ebsa/pdf; “Private Pensions: Changes needed to Provide 401(k) Plan Participants and the Department of Labor Better Information on Fees,” (GAO Study”).

3. Archer v. Securities and Exchange Commission, 133 F.2d 795, 803 (8th Cir. 1943).

Copyright InvestSense, LLC 2023. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.