James W. Watkins, III, J.D., CFP EmeritusTM, AWMA®

Most pension plans use mutual funds as the primary investment options within their plan. The Restatement of Trusts (Restatement) states that fiduciaries should carefully compare the costs and risks associated with a fund, especially when considering funds with similar objectives and performance.1 The Restatement advises plan fiduciaries that in deciding between funds that are similar except for their costs and risks, the fiduciary should only choose the fund with the higher costs if the fund “can reasonably be expected” to provide a commensurate return for such additional costs and/or fees.2

Given the historical underperformance of many actively managed mutual funds, factoring in commensurate returns can be a significant hurdle that pension plan fiduciaries too often fail to properly consider. A fund with higher costs that fails to provide a commensurate return to a plan participant, namely a higher positive incremental return than the fund’s incremental costs, has no inherent value to an investor and is clearly imprudent.

A common argument by the financial services industry, and even some courts, is that a fiduciary is not legally bound to select the least expensive investment option. However, that argument, focusing only on costs, can be misleading, as other factors must be considered. TIAA-CREF properly summed up a plan sponsor’s fiduciary obligations with regard to factoring in an investment’s costs, stating that

[p]lan sponsors are required to look beyond fees and determine whether the plan is receiving value for the fees paid. This should include an evaluation of vital plan outcomes, such as retirement readiness, based on their organization’s values and priorities.3

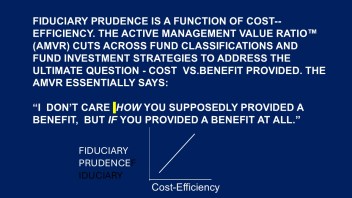

So, how does one determine whether a plan is “receiving value,” an actual benefit from a plan adviser’s advice? Businesses often use a simple and straightforward cost/benefit analysis to determine whether to pursue a project based on the cost-efficiency of the project. When a cost/benefit analysis indicates that the projected costs exceed the projected benefits, the project is usually deemed cost-inefficient and is not worth pursuing.

A simple cost/benefit analysis would seem to be a natural part of a prudent process for plan sponsors to use evaluating the fiduciary prudence of investment products in defined contribution plans (DCPs). However, based on the evidence, very few plans seem to use cost/benefit analyses as part of their fiduciary prudence process. Furthermore, even when plans do use cost/benefit analysis, there are often legitimate questions as to whether such analyses were properly conducted.

An obvious question would be why some plans not use cost/benefit analyses in conducting their legally required independent and objective investigation and evaluation of investment options for their plan. Costs that exceed benefits would seem to be a simple enough standard.

Perhaps the answer lies in the fact that actively managed mutual funds continue to compose the majority of investment options within current defined contribution plans. Studies have consistently shown that the overwhelming majority of actively managed mutual funds are cost-inefficient, as they fail to even cover their costs.

99% of actively managed funds do not beat their index fund alternatives over the long term net of fees.4

Increasing numbers of clients will realize that in toe-to-toe competition versus near–equal competitors, most active managers will not and cannot recover the costs and fees they charge.5

[T]here is strong evidence that the vast majority of active managers are unable to produce excess returns that cover their costs.6

[T]he investment costs of expense ratios, transaction costs and load fees all have a direct, negative impact on performance….[The study’s findings] suggest that mutual funds, on average, do not recoup their investment costs through higher returns.7

The Active Management Value RatioTM

Research has consistently shown that most people are more visually oriented when it comes to understanding and retaining information. Therefore, as a plaintiff’s attorney, I created a simply metric, the Active Management Value Ratio™ (AMVR) to provide a visual representation of the academic studies’ findings with regard to the performance of actively managed mutual funds, most notably the research of investment icons, including Nobel laureate Dr. William F. Sharpe, Charles D. Ellis, and Burton L. Malkiel.

[T]he best way to measure a manager’s performance is to compare his or her return with that of a comparable passive alternative.8

So, the incremental fees for an actively managed mutual fund relative to its incremental returns should always be compared to the fees for a comparable index fund relative to its returns. When you do this, you’ll quickly see that that the incremental fees for active management are really, really high—on average, over 100% of incremental returns.9

Past performance is not helpful in predicting future returns. The two variables that do the best job in predicting future performance [of mutual funds] are expense ratios and turnover.10

The beauty of the AMVR is its simplicity. In interpreting a fund’s AMVR scores, an attorney, fiduciary or investor only must answer two simple questions:

1. Does the actively managed mutual fund produce a positive incremental return?

2. If so, does the fund’s incremental return exceed its incremental costs?

If the answer to either of these questions is “no,” then the fund does not qualify as cost-efficient under the Restatement’s guidelines.

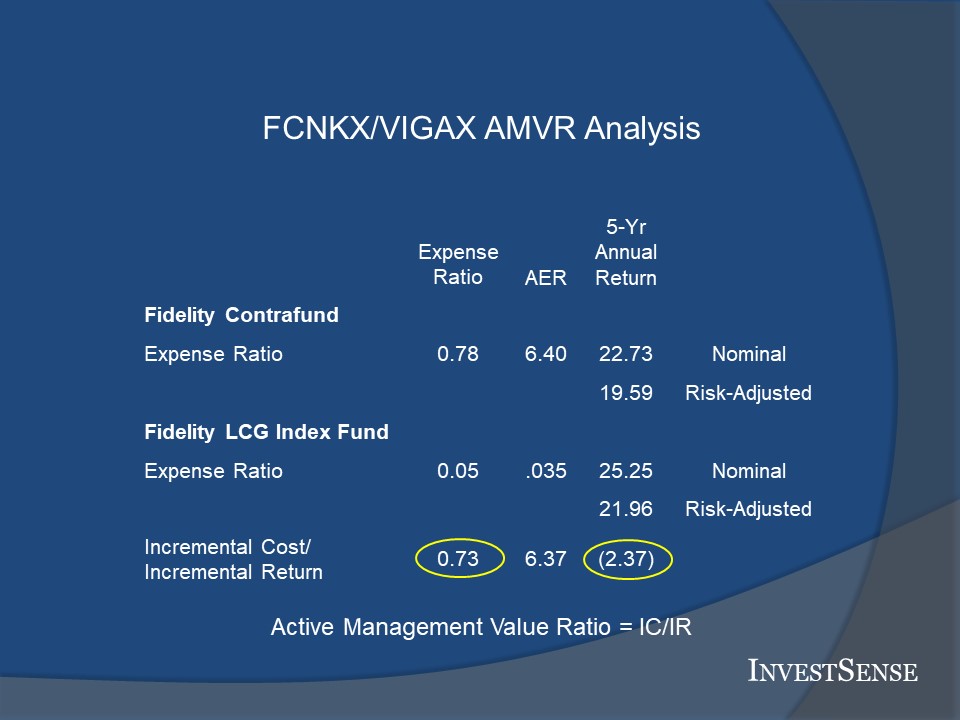

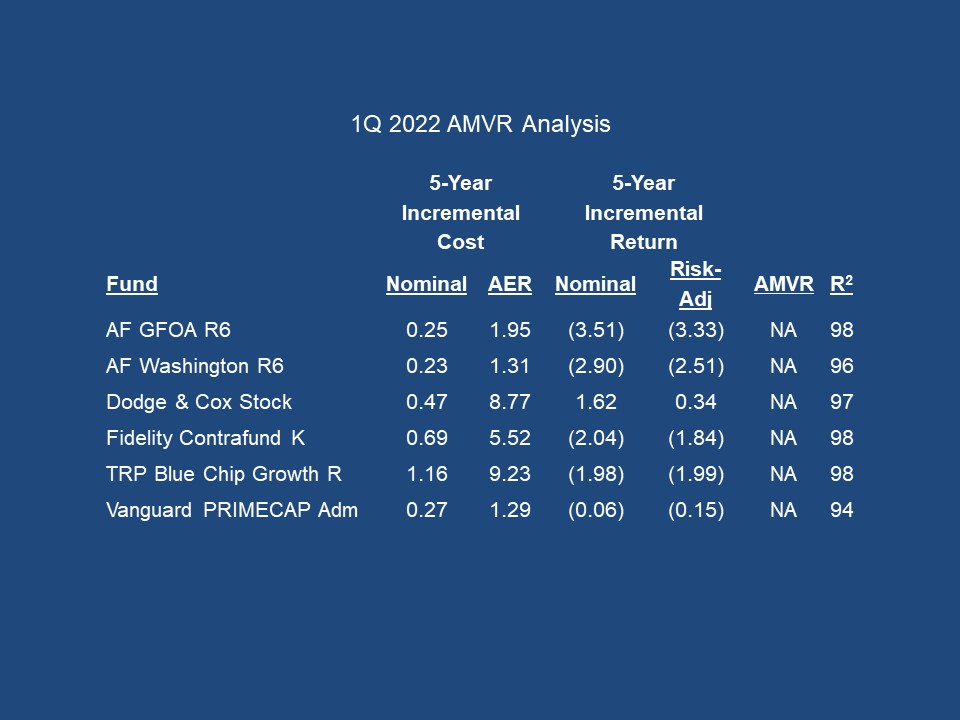

The AMVR slide shown above is a cost/benefit analysis comparing the retirement shares of two popular large cap growth mutual funds, one an actively managed fund, the other an index fund.

A simple analysis shows that the actively managed fund’s incremental costs exceed the fund’s incremental negative returns. Since costs exceed returns, this would result in the actively managed fund being cost-inefficient relative to the index fund for the time period studied.

The Securities and Exchange Commission and the General Accountability Office have both found that each additional 1 percent in costs/fees reduces an investor’s end-return by approximately 17 percent over a twenty year period.11 If we treat the incremental underperformance of the actively managed fund as an opportunity cost, and combine that number with the incremental costs, based on the fund’s stated expense ratio, the projected loss in end-return inour example would be approximately 35 percent over a twenty year period

But does the nominal/stated cost version of the AMVR actually reflect the costs incurred by plan participants if the actively managed fund is selected within a plan?

The Active Expense RatioTM

In a 2007 speech, then SEC General Counsel, Brian G. Cartwright, asked his audience to think of an investment in an actively managed mutual fund as a combination of two investments: a position in an “virtual” index fund designed to track the S&P 500 at a very low cost, and a position in a “virtual” hedge fund, taking long and short positions in various stocks. Added, together, the two virtual funds would yield the mutual fund’s combined costs

The presence of the virtual hedge fund is, of course, why you chose active management. If there were zero holdings in the virtual hedge fund-no overweightings or underweightings-then you would have only an index fund. Indications from the academic literature suggest in many cases the virtual hedge fund is far smaller than the virtual index fund. Which means…investors in some of these … are paying the costs of active management but getting instead something that looks a lot like an overpriced index fund. So don’t we need to be asking how to provide investors who choose active management with the information they need, in a form they can use, to determine whether or not they’re getting the desired bang for their buck?12

Fortunately, Ross Miller introduced a metric, the Active Expense Ratio (AER), which, when combined with the AMVR, allows fiduciaries and investors to perform the type of analysis Cartwright suggested. Miller explains the importance of the AER as follows:

Mutual funds appear to provide investment services for relatively low fees because they bundle passive and active funds management together in a way that understates the true cost of active management. In particular, funds engaging in ‘closet’ or ‘shadow’ indexing charge their investors for active management while providing them with little more than an indexed investment. Even the average mutual fund, which ostensibly provides only active management, will have over 90% of the variance in its returns explained by its benchmark index.13

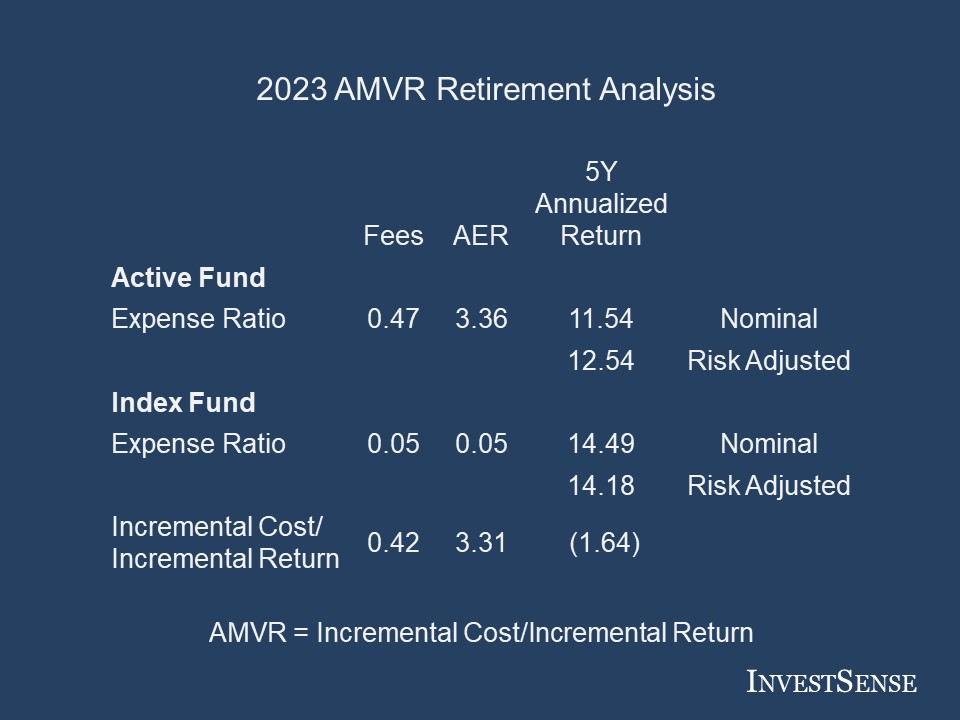

In the AMVR example shown, using nothing more than just the actively managed fund’s r-squared number and its incremental cost, the AER estimates the actively managed fund’s implicit expense ratio to be 3.36, resulting in an incremental correlation-adjusted expense ratio/costs of 3.31. Combined with the actively managed fund’s underperformance, and using the DOL’s and GAO’s findings, that would result in a projected loss of approximately 84 percent over a twenty year period.

The Fiduciary Prudence Score™

The AMVR provides all of the information needed to perform several types of cost/benefit analysis. The AMVR equation, incremental correlation-adjusted costs divided by incremental risk-adjusted return, provides an analysis of the premium paid by anyone investing in the actively managed mutual fund, relative to an investment in the benchmark index fund.

While the AMVR is simple enough, some have suggested that a more traditional metric focusing on return relative to costs would be more helpful and easier to understand. For some, the issue with the AMVR format seems to be that funds that do not produce a positive incremental return are not eligible for an AMVR rating due to their failure to produce a positive incremental return for an investor.

The AMVR metric makes it easy to produce a more return-focused cost/benefit analysis by flipping the original equation so that the incremental risk-adjusted return becomes the numerator and the incremental risk-adjusted costs becomes the denominator. This new metric is known as the Fiduciary Prudence Score™ (FPS).

In using the FPS, the goal is a ratio above 1.00, which would indicate that the actively managed fund’s incremental risk-adjusted return was greater than the fund’s incremental costs. The higher the fund’s FPS, the greater the value provided.

In the AMVR example shown above, the actively managed fund’s FPS would be zero due to the fund’s failure to provide a positive incremental risk-adjusted return. The zero score would indicate that the fund would be imprudent under the Restatement (Third) of Trust’s fiduciary prudence standards.

Some people have indicated an aversion to working with decimal points. In that case, simply multiply the FPS discussed above by 100 to get the more common 1-100 format. Anyone deciding to use the 1-100 format must keep in mind that the FPS score produced is a relative score, not an absolute score. In interpreting the FPS using the 1-100 format, a score above 100 would be needed to establish that the actively managed fund provided value, provided incremental risk-adjusted returns that were greater than the fund’s correlation-adjusted incremental costs.

While other benchmarks could obviously be tested, using either form of incremental costs as the numerator, the cost-consciousness/cost-efficiency requirements of the Restatement would also have to be considered.

Annuities and Breakeven Analysis

“I’m not so much concerned about the return ON my money as I am the return OF my money. – Mark Twain

The post, “Annuities Are the Antithesis of Fiduciary Prudence,” was primarily the result of an AI search on Stanford University’s excellent new AI platform, STORM. One of the interesting features of STORM is its “BrainSTORMing” feature, short analyses on specific aspects of the subjects of the AI search. Another useful aspect of STORM is its liberal supply of footnotes, which allow for greater in-depth analysis on the topic. I have found the STORM platform very useful and accurate, which is why I decided to highlight the platform in a post

The report itself was originally published on our sister site, “The Prudent Investment Fiduciary Rules.” (fiduciaryinvestsense.com) As for the report itself, note that the breakeven analysis shows that the odds are heavily against the annuity owner ever breaking even, from ever recovering 100% of their original investment, resulting in the annuity issuer receiving most of the original investment, not the owner or the owner’s heirs. This is the reason why estate planning attorneys often refer to lifetime income annuities as estate planning “saboteurs. ” as such annuities typically deplete the estate of the assets necessary to implement the annuity owner’s estate plan and final wishes.

This is why InvestSense always recommends that plan sponsors insist that anyone recommending anyone investment for a 401(k) plan support such recommendations with a written forensic analysis before including the asset in a plan, an AMVR analysis for mutual funds and a properly prepared breakeven analysis for annuities, an analysis that factors in both present value and mortality risk. Fair warning – The party making the recommendations will typically refuse to provide such analyses, as they know the true value of their advice. They just do want a client to know. Such supporting analyses may also help demonstrate the due diligence measures that the plan used in selecting a plan’s investment options.

Going Forward

[A plan sponsor’s fiduciary duties are] “the highest known to the law.”14

In reviewing some recent court decisions involving defined contribution plan (DCP) litigation alleging a fiduciary breach, some courts have seemingly lost sight of ERISA’s defined goal, that being to protect workers and to help them prepare for retirement. Some courts rarely address the issue of whether the DCP’s investment options produce value for plan participants. As mentioned earlier, a prudent DCP investment option is one that is cost efficient, one whose benefits are at least commensurate with the fund’s extra cost and risks.

The problem for many DCP plan sponsors and other DCP fiduciaries is the history of consistent underperformance by many actively managed mutual funds relative to passively managed index funds. The FPS could reduce the time and costs of performing the legally required independent investigation and evaluation of each investment option chosen for a plan.

The simplicity of both the AMVR and the FPR should improve the quality of investments chosen for a DCP plan, thereby reducing the risk of litigation and unwanted fiduciary liability exposure. The combination of the AMVR and the FPS could easily expose situations where the plan adviser is not providing value for the plan or its participants, in which case a prudent plan sponsor should consider replacing the plan provider in order to reduce any potential future fiduciary liability exposure.

By combining the AMVR and the FPS, DCP plan sponsors should be able to use “humble arithmetic” to easily create and maintain win-win DCP plans that provides value for both the plan sponsor, the plan participants, and their beneficiaries.

The other motivation behind this post is to reinforce the advice we provide to all of our fiduciary risk management clients – that being to always include in all plan advisory contracts that the plan adviser must always provide written fiduciary prudence analyses to support each recommendation provided by a the adviser. Such a requirement not only establishes the due diligence of both the plan sponsor and the plan adviser, but can also serve as evidence in cases where litigation becomes necessary. Plan advisers are typically well paid. If questions arise regarding the reasonableness of such compensation, such forensic analyses can serve to try to justify such additional costs.

Notes

1. Restatement (Third ) Trusts §90 cmt m. Copyright American Law Institute. All rights reserved.

2. Restatement (Third) Trusts §90 cmt h(2). Copyright American Law Institute. All rights reserved.

3. TIAA-CREF, “Assessing the Reasonableness of 403(b) Fees,” https://www.tiaa.org/public/pdf/performance/ReasonablenessoffeesWP_Final.pdf.

4. Laurent Barras, Olivier Scaillet and Russ Wermers, False Discoveries in Mutual Fund Performance: Measuring Luck in Estimated Alphas, 65 J. FINANCE 179, 181 (2010).

5. Charles D. Ellis, The Death of Active Investing, Financial Times, January 20, 2017, available online at https://www.ft.com/content/6b2d5490-d9bb-11e6-944b-eb37a6aa8e.

6. Philip Meyer-Braun, Mutual Fund Performance Through a Five-Factor Lens, Dimensional Fund Advisors, L.P., August 2016.

7. Mark Carhart, On Persistence in Mutual Fund Performance, 52 J. FINANCE, 52, 57-8 (1997).

8. William F. Sharpe, “The Arithmetic of Active Investing,” available online at https://web.stanford.edu/~wfsharpe/art/active/active.htm.

9. Charles D. Ellis, “Letter to the Grandkids: 12 Essential Investing Guidelines,” https://www.forbes.com/sites/investor/2014/03/13/letter-to-the-grandkids-12-essential-investing-guidelines/#cd420613736c

10. Burton G. Malkiel, “A Random Walk Down Wall Street,” 11th Ed., (W.W. Norton & Co., 2016), 460.

11. Pension and Welfare Benefits Administration, “Study of 401(k) Plan Fees and Expenses,” (DOL Study) http://www.DepartmentofLabor.gov/ebsa/pdf; “Private Pensions: Changes Needed to Provide 401(k) Plan Participants and the Department of Labor Better Information on Fees,” (GAO Study).

12. SEC Speech: The Future of Securities Regulation: Philadelphia, Pennsylvania: October 24, 2007 (Brian G. Cartwright). http://www.sec.gov/news/speech/2007/spch102407bgc.htm

13. Ross Miller, “Evaluating the True Cost of Active Management by Mutual Funds,” Journal of Investment Management, Vol. 5, No. 1, 29-49 (2007) https://papers.ssrn.com/sol3/papers.cfm?abstract_id=746926.

14. Restatement of Trusts 2d § 2, comment b (1959). ” Donovan v. Bierwirth, 680 F.2d 263, 272 n.8 (2d Cir. 1982)

Copyright InvestSense, LLC 2025. All rights reserved.

This article is for informational purposes only, and is neither designed nor intended to provide legal, investment, or other professional advice since such advice always requires consideration of individual circumstances. If legal, investment, or other professional assistance is needed, the services of an attorney or other professional advisor should be sought.

lknolknokn;p